How To Pay Off Debt

How To Pay Off Debt

Taking on debt and paying it off is not easy but it is worth it. Below I will discuss a few methods about how to pay off debt. I will also discuss the benefits of paying off debt to make more income available to spend your money freely.

Avalanche Method

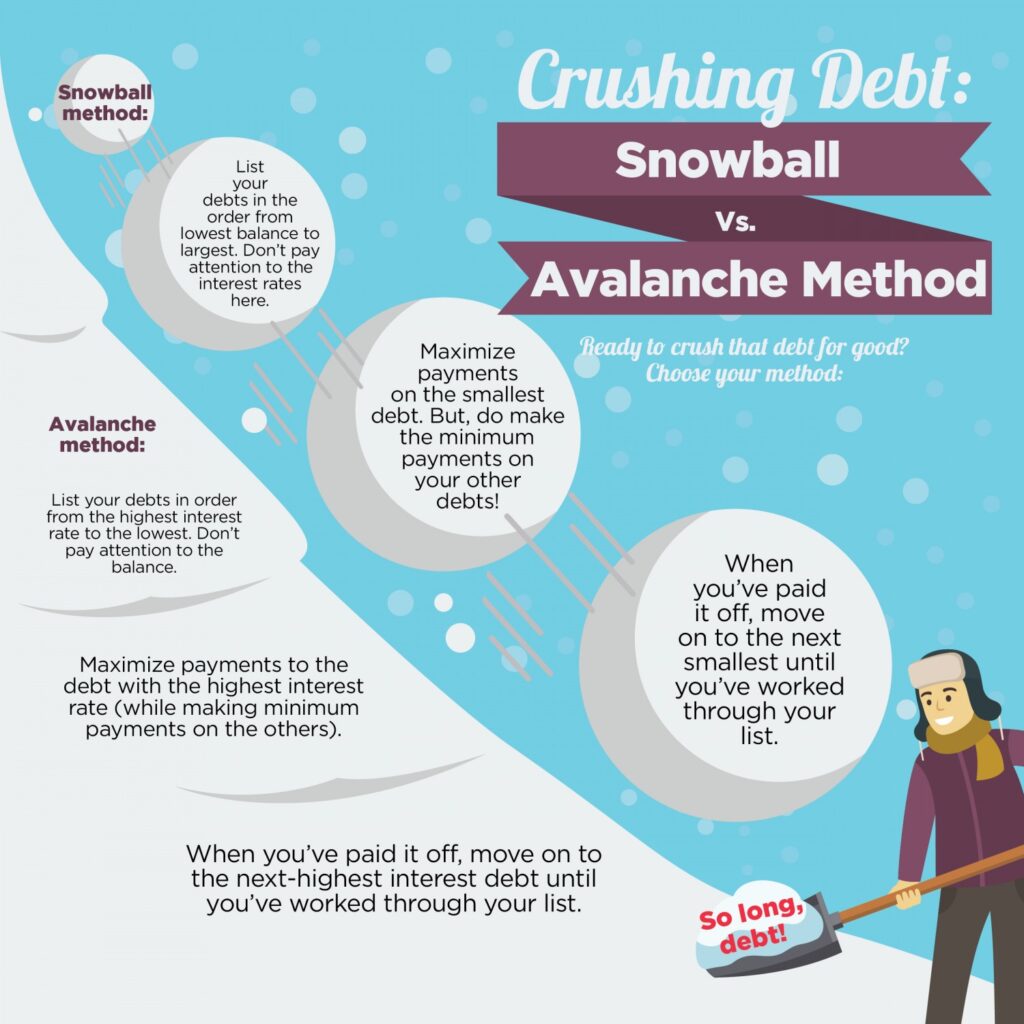

The avalanche method is a debt payoff term in the personal finance community that involves tackling the debt with the highest interest or the annual percentage rate (APR) first. Let’s say you have one credit card with a $5,000 balance with an interest rate of 20% and another with a $2,000 balance with a 14% interest rate. In this example it would be worthwhile to tackle the debt with the highest interest as your main priority while still making the minimum payments on other debts.

Snowball Method

The snowball method is another debt payoff term in the personal finance community. With this method you will aim to pay off the debt with the smallest balance first, similar to rolling a snowball to make it larger. You would tackle the the smallest debt first and then go from there up to the largest debt.

Some are skeptical of this method due to not factoring in interest rates and only focusing on the balance of the loan. But some people like this method because it may be easier to pay off the smaller loans. This can give a sense of accomplishment. It can also be great motivation to pay off the bigger debts.

Paying Down The Principal

If you are in debt but have the extra income to pay off your debt you can often make additional payments on the principal of a loan. The benefit of this is you can pay off the loan faster and reduce interest in the process. You will need to contact your loan officer to discover your options and to avoid any additional fees.

Debt Relief Programs

Debt relief provisions are made available to those who need it. There should be no shame in taking advantage of it. If you are in medical debt, many non-profit hospitals have a debt relief program. Some people may need emergency medical care who do not have insurance. Hospital bills can be hundreds of thousands of dollars for someone with a serious condition. Charity care is to provide discounted or free healthcare to those who are uninsured or underinsured. You will have to meet some requirements but many hospitals have a budget for this. It is a provision to help those who need it.

The Dark Side Of Borrowed Money

It might be easy to just put everything on a credit card but credit cards come with some of the highest interest rates and that is how they get you. There are differences between needs and wants and sometimes we need to keep that in perspective. Rather that buy your dream car, maybe buy a used car that is thousands of dollars cheaper. Vehicles are depreciating assets and they will lose their value. Or rather than buy that luxury purse maybe think of other ways that this money can be better spent. There’s nothing wrong with occasionally treating yourself and buying some wants but it should be balanced.

There is a bad reputation going around about credit cards. There is hate about how they are to blame for putting people into debt. The credit card companies have one goal and that is to make money from interest. They know not everyone will pay off their balance in full on time. It’s honestly just business but it doesn’t have to be your business. But no one is forcing you to swipe the card. I do not think credit cards are evil, quite the opposite actually. They provide protections that cash or debit do not. This can include protections from fraudulent charges and some provide cash back. But they need to be used responsibly and paid off on time to avoid getting into more debt. Uncontrolled spending can put you in a bad position if you’re not careful. You are borrowing money, after all.

It is also important to acknowledge who you’re trying to impress, because if you’re honest with yourself…it’s someone. People don’t just want the biggest mansions, the luxury clothes, or the most expensive cars for no reason. It has almost become like a competition when I see these celebrities trying to outdo another. There’s always a reason even if it’s subconsious and it is important to address where that void comes from. It is natural as humans to want to feel accepted and to try to fit in but at what cost? If you need to go into debt to feel accepted then whoever you are trying to impress is not worth your time.

Financial Literacy

The very purpose of this blog is financial literacy. Once you know better, you can do better. When it comes to debt, if you need to make it easier on yourself consider automating your finances. When money is out of sight, it is out of mind.

But there are a few valid questions. What if you pay off your debt and get into debt again? What if your income doesn’t allow you to pay off much in terms of debt? Well, this is where financial literacy comes in at.

Being alive and being an adult costs money and it’s true that we can’t always afford things. Not taking on debt (or additional debt) is possible but that’s not always realistic for everyone and it is important to acknowledge that. The cost of living in many places has not kept up with income and that makes it even more difficult to not get into debt and to save. Larger ticket items such as a home is higher than it’s ever been and a mortgage is a big commitment and big financial burden. Some may be in medical debt which I will not delve too much into due to the infrastructure of the American healthcare system, but you get my point.

Ultimately, if your income does not allow you to pay off much in terms of debt, try to pay off the minimum at the very least. Although this is easier said than done, find ways to increase income and live below your means. Even if your income increases that doesn’t mean your lifestyle has to. You are not alive just to pay bills and get out of debt.

Paying off debt is a process but it is worth it. Not owing anyone anything and the freedom that comes with using your money how you want is the goal. Although getting out of debt can be stressful, keep in mind that some progress is still progress whether you pay an extra $20 or $200. Ultimately, as long as you pay down your debt and eventually pay it off that is the most important factor. Do what works for you.

View your finances like a business – run your business like HR during payroll. Have a budget, allocate funds towards bills and debts, and keep account of where your money is going. Have a payment plan for paying off your debt and one day you’ll be debt free and living the better version of the American Dream – yours.