How To Beat Inflation

How To Beat Inflation

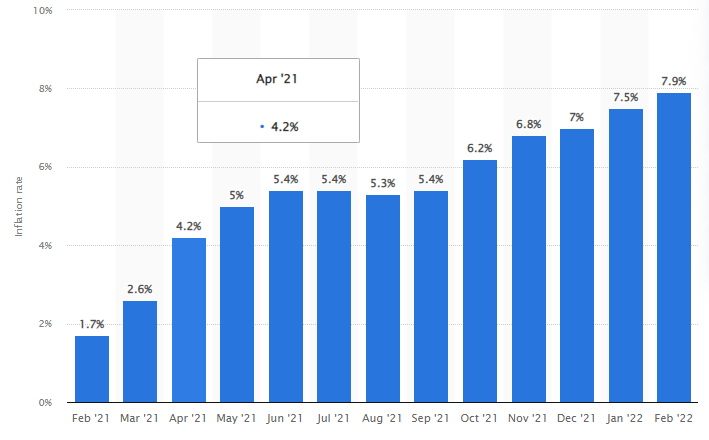

Have you even wondered how to beat inflation? Inflation is a byproduct of an economy that runs on money. Data from Statista has shown that inflation has increased from 3.2 percent in 2011 to 4.7 percent in 2021 and in February 2022 it has risen to 7.9 percent – and it’s continuing to rise.

How can you reduce inflation’s impact on your lifestyle and your finances? First, let’s define what inflation is.

What Is Inflation?

In economics inflation is a decrease in the purchasing power of money and an increase in the prices of goods and services in the economy. Inflation is measured on a monthly basis using the Consumer Price Index, hence why February 2022 specifically lists 7.9%.

What Is The Cause Of Inflation?

There can be various causes of inflation. A few causes can include increases in the cost of production (referred to as cost-push), spikes in demand (referred to as demand-pull), increased money supply, national debt, increased wages (referred to as built-in), and even world wars having economic costs.

How Is Inflation Impacting People?

Inflation impacts people in different ways depending on the person’s circumstances. The rising costs of gas, food, rent, and utilities can put people in dire straits to survive. These things are necessities because people need food to stay alive, housing to stay safe, and gas to drive to and from work. This is especially true considering that many jobs are not increasing salaries to compensate employees for the rising costs of inflation. Basically, this leaves people with higher costs of living with a stagnant salary.

How Can You Beat Inflation?

A few pointers that I can give to survive inflation is to be proactive. This comes down to living below your means when it comes to housing and the type of vehicle you purchase (including maintenance costs). A problem with Western civilization is that everyone wants the best of the best and unfortunately it is often to keep up with the Joneses. Most people would not care about the best of the best if no one could see it which puts the intention for owning it into prospective. It is fine to want nice things in life but I am very much against the concept of looking rich versus being rich. People would rather go into debt to appear rich or fake it until you make it rather than acknowledge their current circumstances. This leads people to buying expensive luxury vehicles, large homes, and getting into unnecessary debt.

I love to preach affordability versus justification. Even if one can afford something bigger or better does not always mean there is a justification to get something bigger or better. Again, why fix what isn’t broken?

So, the three best ways to beat inflation is to maximize your income (which granted is easier said than done), not falling into the trap of consumerism while remembering the affordability versus justification concept, and to live below your means. Even if your salary increases, your lifestyle does not have to. In fact, I would advise anyone who can afford to invest any salary increase to do so because your return on investments (ROI) can help with inflation. This is how you beat inflation.

Take Advantage Of Credit Cards

One other overlooked way to beat inflation are credit cards – with responsible usage. Credit cards can offer great cash back perks which can help reduce the blow of inflation. Some credit cards offer between 1.5%-6% back when making certain purchases such as at gas stations or grocery stores – places you spend money at anyway and things that are necessities.

In conclusion, remembering the affordability versus justification concept will take you far in life when it comes to refusing to fall into the trap of consumerism, reducing your carbon footprint, and finding contentment in living below your means.

Q: What are some ways that you personally beat inflation?