Best Checking Accounts [2023]

Best Checking Accounts

There are useful purposes for utilizing a checking account including keeping frequently used funds for paying bills. This can also protect you from the potential risk of theft by preventing access to your savings account. Below I list the two best checking accounts that offer competitive incentives.

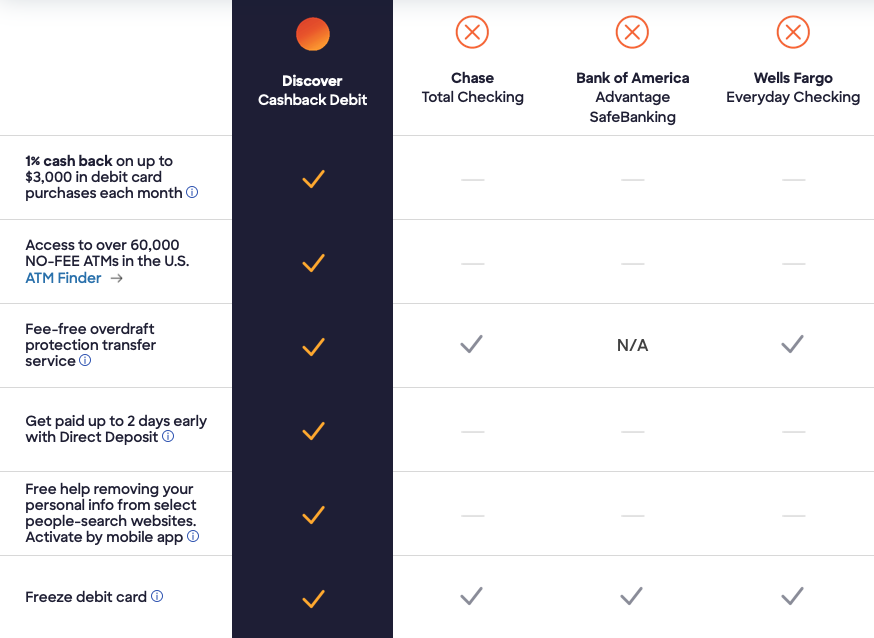

Discover Checking

Discover checking offers 1% cash back on purchases each month. The account does not charge any monthly maintenance or insufficient fund fees. You can get paid early with direct deposit and you also get free access to over 60,000 ATMs. Most importantly this bank is FDIC insured.

Fidelity Cash Management

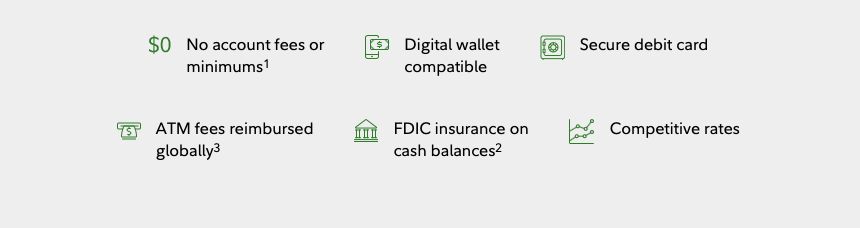

This Fidelity account has the features of a traditional checking account without the fees. Fidelity offers a higher annual percentage yield (APY) than traditional banks for checking accounts. The cash management account has no account fees or minimum balances and ATM fees are reimbursed. It basically has similar features to the Discover checking account. This bank is also FDIC insured.

The Fidelity checking account might be a great option for you if you already utilize their investing services as they have a wide array of investment options on their platform.

The one con to utilizing digital banks is that you cannot deposit checks or cash at am ATM, you can only withdraw. However, the mobile app makes it easy to deposit checks.

The type of account you choose will depend on your own personal circumstances and wants. If you want to keep it in the family, Fidelity and Discover also offer credit cards that provide excellent perks.