Best Cash Back Credit Cards

Best Cash Back Credit Cards

I would like to introduce you to the best cash back credit cards (in my opinion). Credit cards can offer great benefits when used responsibly. A few of those benefits include cash back, travel points, and travel protection.

In the credit card community there is this thing called churning. Churning involves applying for a credit card, getting approved, and meeting a minimum spend amount within a certain timeframe to earn the specified bonus and then canceling the card before the annual fee is due. Then you rinse and repeat. I do not advocate for this because most people will buy things they do not need to quality for the spend amount to get the bonus or rack up lots of credit cards that result in closed accounts.

Having lots of open credit cards can leave you open to security risks since it will be more difficult to monitor your accounts and there is no justifiable reason to have a million cards when a few at most would sufficiently offer complimenting benefits to the other. I promise that there is a way to reap the benefits of credit cards without the inconvenience and security risks of churning.

I am however an advocate for responsibly used credit cards preferably with no annual fees and a minimum amount of credit cards to serve your spend purpose. Below are the credit cards that I either personally have or I have done research on and they offer great perks:

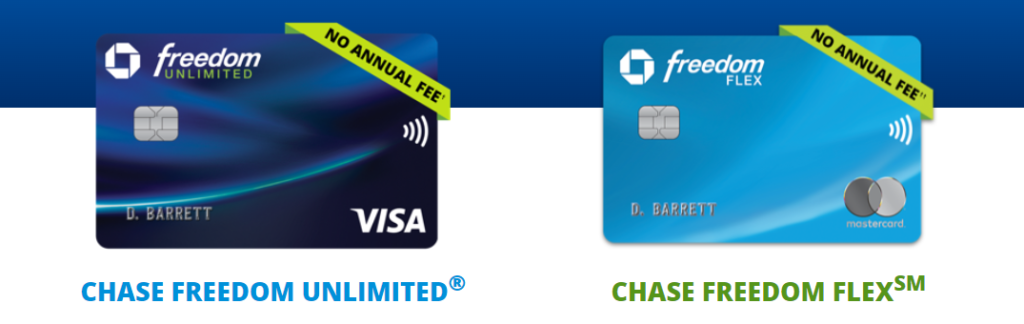

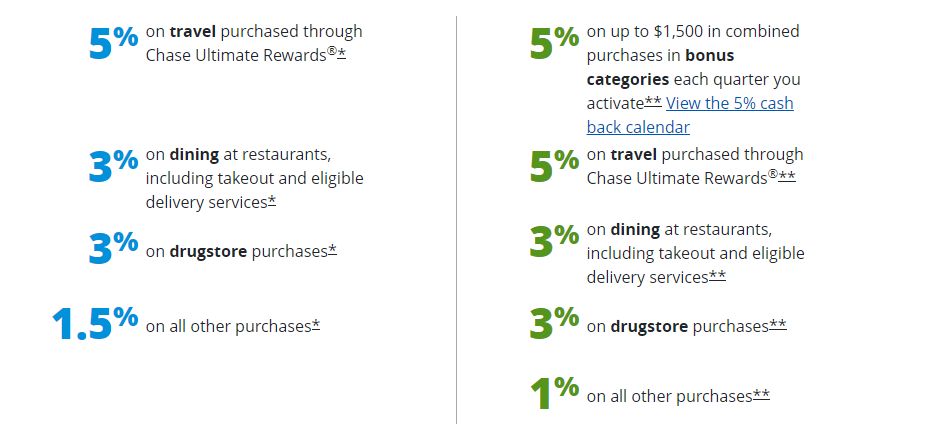

Chase Freedom Unlimited/Freedom Flex

Both of these Chase credit cards offer a sign on bonus, they have no annual fee, and 0% APR for the first 15 months. There is no minimum redemption amount for cash back. Both cards give you free access to your FICO score through Credit Journey. Both cards offer purchase protection, trip cancellation insurance, and auto rental collision insurance. The Chase Flex also offers cell phone protection against theft or damage with a $50 deductible per claim.

For more information about additional card benefits please visit the card issuer’s website.

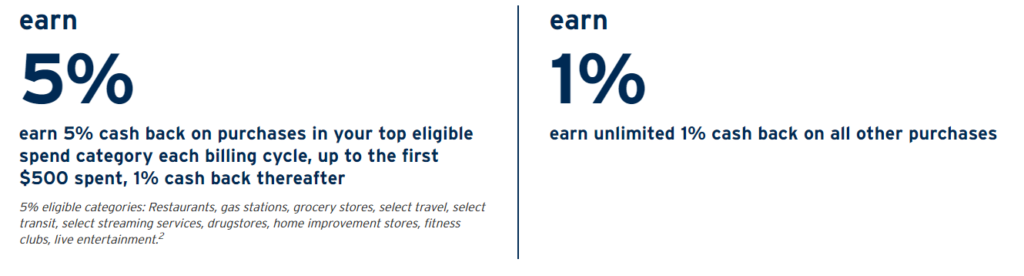

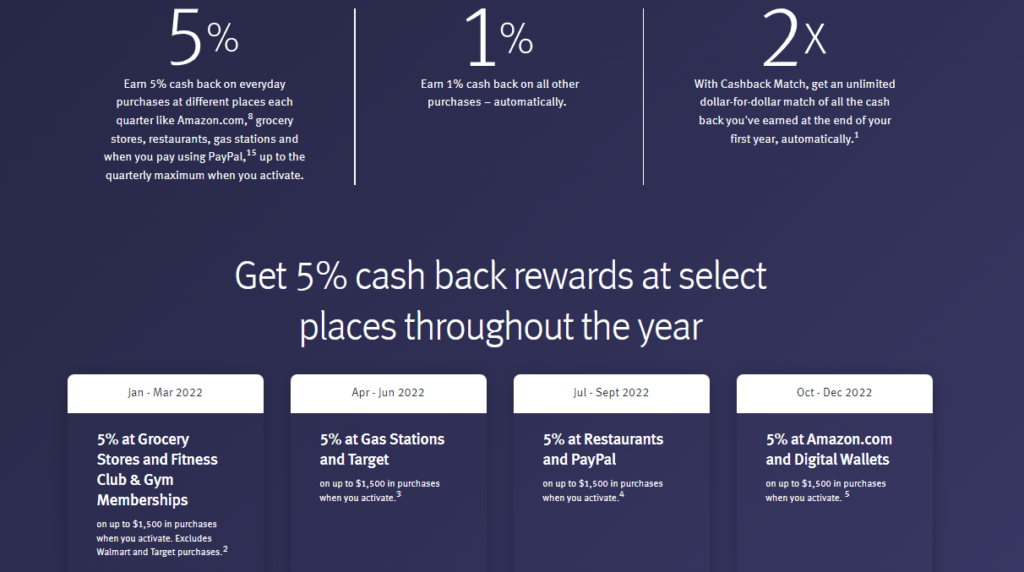

This card is beneficial for those who want a 5% card for a specific spend category such as gas or groceries. It offers a sign on bonus and 0% APR for the first 15 months and there is no annual fee. There is no minimum redemption amount. This card also gives you free access to your FICO score.

For more information about additional card benefits please visit the card issuer’s website.

I would like to disclose that all Discover credit cards have no foreign transaction fees which make them great for travel. There is 0% APR for the first 15 months, there is no annual fee, they have various fun card designs to pick from, their customer service is 100% U.S. based, and you get access to your FICO score for free. There is no minimum amount to redeem cash back.

For more information about additional card benefits please visit the card issuer’s website.

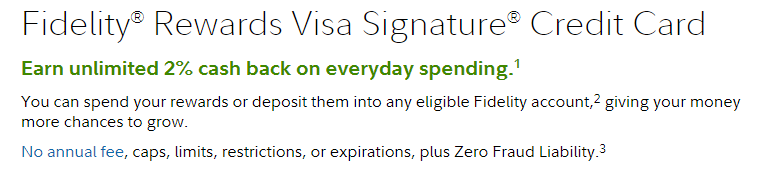

This credit card is comparable to the Citi Double Cash but you can deposit the points that you earn from this credit card directly into an eligible Fidelity account such as a brokerage, cash management, or a 529 college savings account. This card is great for investing. There are sign on bonuses but they are normally by invitation to your email. This card also offers benefits including purchase security and roadside dispatch which can serve as an alternative to AAA.

For more information about additional card benefits please visit the card issuer’s website.

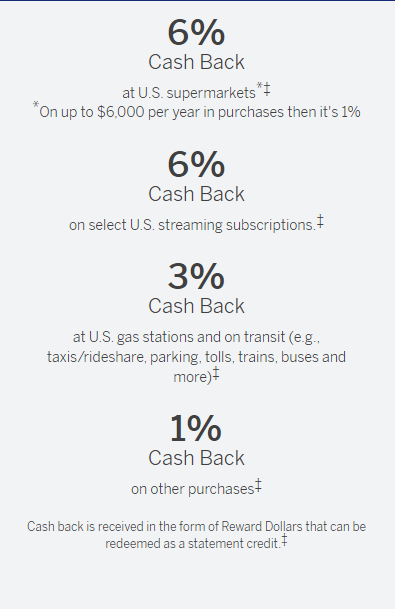

American Express Blue Cash Preferred

This American Express credit card does have an annual fee of $95 but it offers 6% cash back at supermarkets and streaming subscriptions with 3% back on gas so depending on your spending habits in these categories, the annual fee will more than pay for itself. This is a great card if you have a large family and you spend upwards of $6,000 annually on groceries. This card offers a $0 intro annual fee and then it’s $95 after the first year. This card also offers 0% APR for the first 12 months and free access to your FICO score. It has a sign on bonus and comes with many benefits including car rental loss/damage insurance, purchase protection, and return protection. There is a minimum rewards redemption of $25.

For more information about additional card benefits please visit the card issuer’s website.

A huge misconception in the personal finance community is that credit cards are the enemy but user error is the cause of this misconception. Credit cards in themselves are not bad, it’s how you use it. The important part is responsible usage of credit cards so that you do not carry debt. Do not let the 0% intro APR fool you by falling into the trap of consumerism and buying unnecessary things thinking you do not have to pay interest or just to meet the sign on bonus. Oftentimes the sign on bonus can be met through recurring monthly bills and on purchases you would be making anyway. Credit cards can offer certain protections that debit cards just do not have with the added perk of cash back.

I encourage you to explore and do your research on the type of credit card that would serve your spending needs.