A Beginner’s Guide: How To File Taxes

A Beginner’s Guide: How To File Taxes

There is this misconception that filing taxes is difficult and should be left to the professionals. However, filing your taxes does not have to be difficult. Depending on how simple or complicated your taxes are, you can learn how to do them yourself – especially since most software will guide you. All you have to do in most cases is upload a digital copy of your forms. Filing your own taxes will save you money that you would pay to a certified public accountant (CPA). Below is a beginner’s guide about how to file your taxes. The filing deadline in the United States for the 2021 tax year is April 15 of 2022 but the date fluctuates each year.

IRS Free File

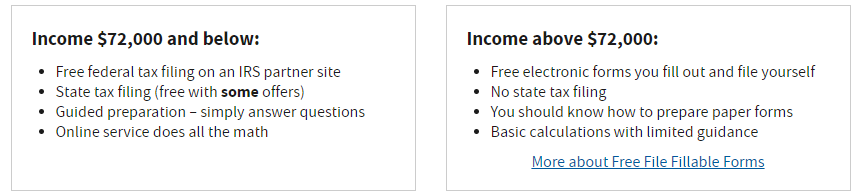

Utilizing IRS free file may be a good option for you depending on your income limits and whether you need to file state taxes. The IRS partners with tax preparation and filing software leaders to provide this software for free. Filing with IRS free file can only be done for the current year and it is not applicable for back taxes.

Each partner company guarantees the accuracy of your return calculations so that you get the highest return. You are able to track your returns using the check my refund status on their website or from the mobile app with daily status updates. Direct deposit is also available for those of you who prefer getting any refunds deposited directly into your bank account.

It is important to note that with the IRS free file if you file under the income limit of $72,000 you won’t get upcharges for HSA, investments, etc. For more information about income limits, guided preparation, and frequently asked questions please visit the IRS free file website.

Free Tax USA

Although the name sounds sketchy, FreeTaxUSA is a legitimate authorized IRS e-file provider owned by TaxHawk.

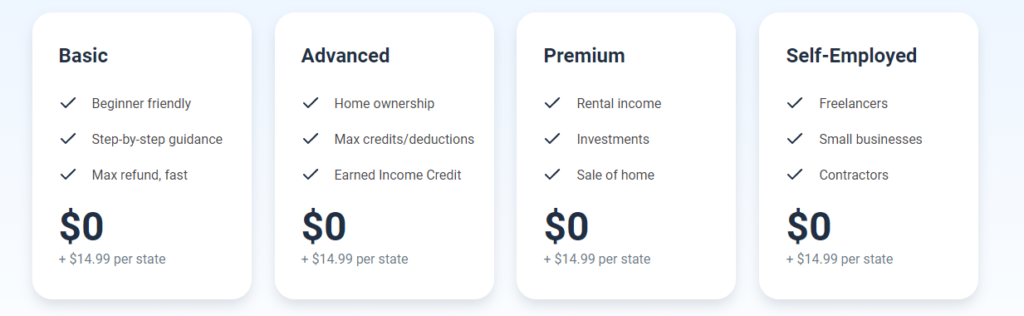

Filing federal taxes with FreeTaxUSA is free for all tiers but it costs about $15 to file state – regardless of tier. Compared to lots of other paid software on the market this one offers low prices for filing state taxes and it also has a nice user interface. Reviews are also important to consider and as of 2021 FreeTaxUSA ranks at 4.8 stars overall. Since prices are subject to change, please visit their website for up to date information.

TurboTax

TurboTax has a very intuitive user interface. There is no overcomplication when it comes to filing online and there is a choice for every tax situation (depending on the tier). The free edition allows you to file federal and state for free but this is for simple (1040) tax situations. Depending on if more tax options are needed, the cost goes up with each tier (for both federal and state) which can exceed the prices of FreeTaxUSA for higher tiers. Since prices are subject to change, please check their website for updated pricing information. Again, also check reviews since those are important about overall usage.

One downside that I personally do not care for is the forced marketing and the option to constantly upgrade to a higher tier even if it is not needed for your tax situation.

Common Forms

- W-2 – employer wage and tax statement

- 1040 – income tax return filed by US citizens or residents

- 5498 – IRA contribution form

- 1098 – mortgage interest statement

- 1098-E & 1098-T – educational tax deductions

Tax Deductions

There are standard and itemized tax deductions for things such as home ownership and work from home expenses (including internet, office equipment, continuing education expenses for licenses and certifications, etc). Deductions can also apply to charitable donations. Most tax filing software will select a deduction option for you depending on what will get you the highest return.

With the 1098-E deduction you can deduct up to $2,500 of student loan debt from your taxable income under certain conditions. Your student loan servicer(s) will send you a copy of your 1098-E form if interest paid meets or exceeds $600.

A 1098-T form is a tuition statement to determine your deduction based on your educational credits, qualified tuition, and related expenses. This form can help you determine whether you qualify for the two tax credits below. However, you cannot claim a tuition and fees deduction and an education tax credit in the same calendar year for the same student.

Tax Credits

The American opportunity credit is for qualified educational expenses for the first four years of college with a maximum credit of $2,500.

The lifetime learning credit is for qualified tuition and related expenses. This credit can also apply to vocational courses to improve your job skills. There is no limit to the number of years you can claim this credit but the credit is worth up to $2,000. You can claim this tax credit even if you did claim the American opportunity credit in the past. However, you cannot claim both credits in the same year.

The earned income tax credit helps low to moderate income workers and their families to reduce the amount owed in taxes or to increase your refund. Eligibility is dependent on adjusted gross income (AGI) and whether you have children or not.

Transparency

I have been doing my own taxes for about 5 years, three of which I previously used TurboTax for. Throughout different points in my life I’ve had to upgrade to deluxe, premier, and self-employment tiers to meet my needs which has become costly and the cost is not justified in my personal opinion. Since my current tax situation heavily involves investments, my software tier needs to include that option – without any absurd upcharges. In my unbiased opinion, most tax filing software offers many of the same benefits such as a guided user interface, guaranteed highest returns, and the end result of making uncle Sam happy. Let’s not make this more complicated or expensive than it needs to be.

“Give a man a fish and you feed him for a day. Teach him how to fish and you feed him for a lifetime.”

Lao Tzu

Ultimately, knowing how to file your own taxes can be beneficial and cost effective for you with the secondary option to seek the guidance of a CPA if needed, especially if you have a more peculiar or complex tax situation. One of the best investments you can make is investing in educating yourself; learning how to file your own taxes is great knowledge to have. There are many other free and paid options available on the market but it is important to find what works best for you and your tax situation. Also, feel free to check out my post about how to get the most out of your tax refund.